Tax season is coming to an end on April 18th. If you have not turned your taxes in yet, there is a good chance you will need to file an extension to avoid penalties for filing late. This article from Nerdwallet does a great job of explaining what an extension is and how it works. Check out the article and give us a call so we can get your extension filed.

Bob Donica

Source:Nerdwallet | Repost Repost RE Donica & Associates 4/13/2023 –

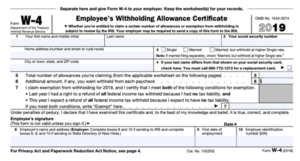

If you haven’t quite got it all together by the time tax day rolls around, there’s no shame in requesting an extension to file from the IRS. The key is remembering that an extension gives you additional time to file, not more time to pay.

What is a tax extension?

A tax extension is a request for additional time to file your federal income tax return with the IRS. In 2023, a tax extension moves the tax-filing deadline to Oct. 16, 2023.

If you think you’ll owe taxes when submit your return, filing a tax extension can help you to avoid incurring a late-filing penalty. To avoid collecting additional penalties and interest, submit a payment for your estimated taxes owed when filing for an extension.