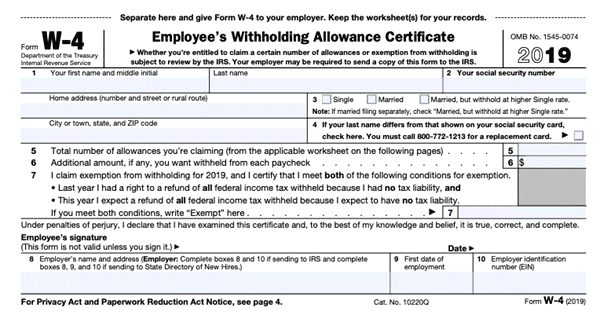

Navigating the complexities of tax forms can be a daunting task for many taxpayers in the United States. However, understanding how to properly fill out a W-4 form can significantly impact your financial health, ensuring you maximize your take-home pay while minimizing your tax liabilities. This guide is designed to help the everyday taxpayer get acquainted with the W-4 form, offering insights into how to complete it for the best possible outcome.

What is a W-4 Form?

The IRS Form W-4, also known as the Employee’s Withholding Certificate, determines the amount of federal income tax withheld from your paycheck. With the introduction of the Tax Cuts and Jobs Act in 2018, the form underwent significant changes, making it crucial for taxpayers to pay attention to how they complete this document.

Why is the W-4 Form Important?

The accuracy of your W-4 directly affects your paycheck and your annual tax return. If too little tax is withheld, you could face a hefty bill or even penalties at tax time. Conversely, overestimating your withholdings might result in a larger refund, but it also means you’re offering the government an interest-free loan rather than having access to that money throughout the year.

Step-by-Step Guide to Filling Out Your W-4

Step 1: Personal Information

This section is straightforward. Fill in your name, address, Social Security number, and tax filing status. Your filing status affects your tax bracket and withholding rate, so it’s crucial to get this right.

Step 2: Multiple Jobs or Spouse Works

If you work more than one job or you’re married filing jointly and your spouse also works, accuracy here is key to determining your total tax liability. You have a few options:

- Use the IRS’s online Tax Withholding Estimator for the most precise withholding amount.

Fill out the Multiple Jobs Worksheet on page 3 of the W-4 form for a rough estimate.If there are only two jobs in total, you can check the box in this section for each job. This method is easiest but may not be as accurate.

Step 3: Claim Dependents

If you have dependents, this section can significantly impact your withholdings. The Child Tax Credit and credit for other dependents are important factors here. Follow the form’s instructions to determine how much to reduce your withholdings by for each qualifying child or dependent.

Step 4: Other Adjustments

This optional section allows you to tailor your withholdings more closely to your financial situation. It includes:

- Other income (not from jobs, such as interest, dividends, and retirement income)

Deductions (other than the standard deduction)Extra withholding (any additional tax you want withheld from each paycheck)

Step 5: Sign and Date

Your form is not valid until you sign and date it. Submit the completed W-4 to your employer’s payroll or human resources department.

Tips for Maximizing Tax Benefits

- Adjust Your Withholdings: If you receive a large refund every year, consider decreasing your withholdings to boost your monthly take-home pay. Conversely, if you owe money come tax season, you may want to increase your withholdings.

Regularly Review Your W-4: Life events such as marriage, divorce, the birth of a child, or a change in income necessitate a review of your W-4. This ensures your withholdings are always in line with your current financial situation.Utilize the IRS Withholding Estimator: For the most accurate withholding, use the IRS’s online tool. This is especially helpful if you have a complex tax situation.

Conclusion

Filling out your W-4 accurately is crucial for managing your taxes effectively. By understanding how to navigate this form, you can ensure you’re not overpaying on taxes throughout the year and are maximizing your financial well-being. Remember, the goal is to align your withholdings as closely as possible with your actual tax liability. Regular reviews and adjustments to your W-4 can keep you on track, helping you avoid surprises at tax time and improve your overall financial health.

If you have not scheduled your appointment yet to get your taxes done, please call us at 317-912-2100.

Robert Donica

Phone: 317-912-2100

Email: [email protected]