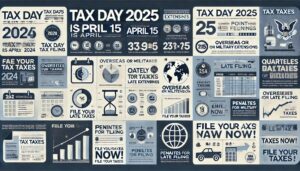

Here is an article on Tax Brackets and Federal Tax Rates for the 2022 tax season. The Nerdwallet article focuses on the tax rates for 2022 and also, the current changes for 2023. There are seven federal tax brackets for the 2022 and 2023 tax years. Being “in” a tax bracket doesn’t mean you pay the federal income tax rate on everything you make, there is a progressive tax system which means people with higher taxable income are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates. I hope this article helps explain our tax system a little better, I will discuss any questions regarding the articles this tax season.

Bob Donica

Source: Nerdwallet | Repost RE Donica & Associates 2/2/2023 –

There are seven federal tax brackets for the 2022 and 2023 tax years: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your bracket depends on your taxable income and filing status.